InfoFi: The AI-Powered Evolution of Influence, Attention, and Markets

Mar 11, 2025

9 min Read

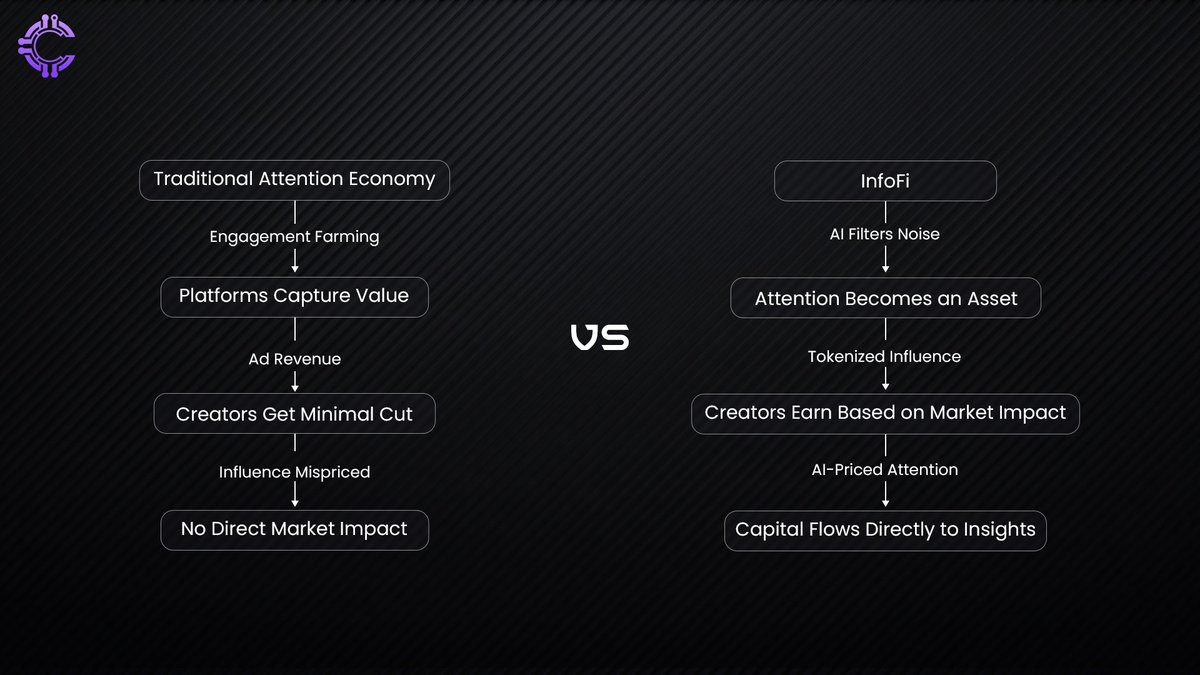

For years, attention was a mispriced asset. Platforms like X, YouTube, and TikTok hoarded its value, turning engagement into a one-sided transaction. Creators built the narratives, but centralized platforms controlled the revenue. Attention was farmed, extracted, and monetized, just not by those actually generating it.

InfoFi changes that. It turns attention into a liquid asset, tokenized, measurable, and driven by real market forces rather than opaque algorithms. This isn’t about vanity metrics anymore. It’s about supply, demand, and actual value. In the old model, engagement was rewarded in clicks. In the InfoFi model, attention is rewarded in capital.

The question is no longer “How much attention can you capture?” but “How much is your attention actually worth?” That changes the entire game. Low-effort engagement farming stops working. Quality, credibility, and verifiable influence take center stage. The system stops rewarding noise and starts rewarding signals.

AI: The Architect of the Attention Economy

InfoFi doesn’t work without AI. The crypto space is an endless flood of narratives, speculation, and misinformation. AI filters through the chaos, determining what matters and what doesn’t. It curates, prices influence, validating data and surfacing real value.

The old attention economy was a volume game. More posts, more clicks, more noise. AI breaks that cycle. It shifts incentives, rewarding precision over spam. In a world where the right piece of information five minutes early can be a game-changer, AI ensures that the market rewards intelligence and not just engagement.

From Noise to Value: The Financialization of Information

The old attention economy was built on volume. A single viral X thread can move token prices, a meme can shift sentiment, and market narratives change in real time. Yet, the value created by these shifts has always been captured by platforms, not the creators driving them.

Here’s where InfoFi changes the equation:

Attention = Influence = Value – Engagement isn’t just content consumption; it’s a financial force. If a tweet can move billions in market cap, it should be treated as an asset.

AI as the Market Maker – AI doesn’t just filter noise from signal; it assigns economic weight to influence. It verifies credibility, tracks impact, and ensures that real value is rewarded.

Tokenizing Information Flow – Instead of ad-based monetization, InfoFi structures attention like a financial market. Those who generate influence—creators, analysts, even communities, get directly rewarded through tokenized incentives.

The End of Gatekeepers – Traditional platforms decide which voices get reach and revenue. In InfoFi, AI and markets dictate whose insights matter, pricing influence dynamically based on real-time impact.

Just as DeFi unlocked open financial systems, InfoFi is unlocking the information economy. The shift is clear: influence is being repriced, and for the first time, the market, will decide what attention is worth.

Kaito: AI as the Backbone of InfoFi’s Attention Economy

InfoFi is reshaping the way influence is priced, and Kaito stands as its most prominent example. In a system where attention is an asset, @KaitoAI leverages AI to track, quantify, and reward real-time information flow. Unlike traditional research tools that merely organize data, Kaito predicts how narratives will evolve before they impact markets. It scrapes X, Discord, and governance forums, filtering through the overwhelming volume of crypto discourse to extract meaningful insights.

This isn’t just about aggregating content, it’s about structuring raw information into market-moving intelligence. Here’s what sets Kaito apart:

AI-Powered Narrative Tracking

Traditional tools react to trends. Kaito predicts them.

AI scans crypto’s most active platforms, filtering noise from valuable insights.

Instead of just delivering data, it curates and structures narratives before they shape market movements.

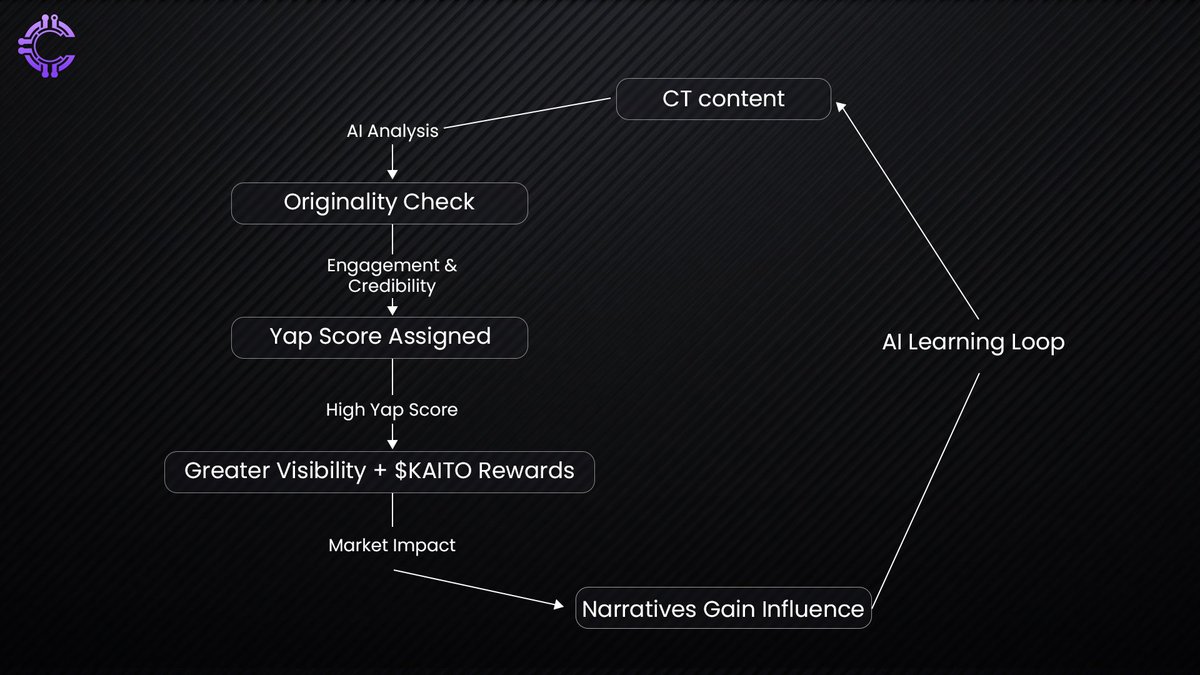

Yaps: Proof-of-Attention for Influence

Kaito didn’t just create another engagement metric, it built a financial system for influence. Yaps aren’t just rewards; they’re proof-of-value in the Kaito ecosystem. Every day, 24,000 Yaps are distributed based on post quality, originality, and engagement from high-reputation accounts.

This isn’t about who posts the most, it’s about who shapes the conversation. Top Yappers earn status, visibility, and governance power, making influence a tradable asset. And with AI-powered Yappers entering the game, the competition for attention as capital is only getting fiercer.

AI assigns a Yap Score based on originality, credibility, and engagement.

High-score posts gain visibility, and their creators earn $KAITO tokens.

This isn’t about who posts the most, it’s about who adds the most value.

Kaito’s Yap-to-Earn model proves one thing: attention isn’t free, it’s financialized.

AI as the Judge, Jury, and Market Maker

Kaito’s AI doesn’t just curate content; it prices influence. By analyzing sentiment shifts and emerging narratives, it determines which insights have market-moving potential.

Instead of relying on vanity metrics like likes and retweets, Kaito’s AI analyzes sentiment, narrative impact, and market relevance to determine the real weight of each post. The most valuable insights are rewarded through Yaps, a dynamic system that incentivizes quality over noise.

With Yap-to-Earn, Kaito ensures that those shaping market narratives receive tangible rewards. AI continuously tracks discussions, identifies high-impact contributions, and distributes Yaps accordingly. This isn’t just engagement—it’s monetized influence, where AI surfaces the most valuable voices and aligns incentives with real market impact.

“If influence moves markets, Kaito is ensuring it gets priced like an asset.”

Market shift: When Attention Becomes the Real Asset

The days of empty engagement metrics are fading. In traditional social media models, likes and retweets were the currency of influence, easy to farm, easy to fake. But in a market where narratives can move billions, engagement alone is a weak signal. Kaito introduces a shift: attention isn’t just measured, it’s valued based on impact. A thread that moves a token’s price by 10% has far more weight than one with a thousand passive likes. AI-driven Yap scores ensure that influence isn’t determined by volume but by verifiable market relevance.

This shift reframes attention as a scarce asset. In the old paradigm, speculation thrived on hype, and algorithms rewarded virality over substance. Kaito flips this, AI assigns worth to insights based on their ability to drive real financial movement. Market-moving narratives aren’t buried under engagement bait; they’re surfaced, quantified, and rewarded. The result? A system where speculation aligns with informed influence rather than mass hysteria.

Beyond Sponsored Hype: Influence as Currency

Kaito isn’t just changing how attention is measured, it’s transforming how projects gain visibility. In traditional models, brands and token projects paid influencers for exposure, hoping to convert attention into action. With Kaito, this dynamic is flipped:

No More Paid Hype

Instead of influencers cashing in on promotional posts, Kaito’s AI rewards organic, market-moving insights.

Projects must now earn attention rather than buy it.

AI-Verified Attention

Getting onto Kaito’s leaderboard means more than just reach, it signals credibility.

AI ensures that influence isn’t dictated by follower count but by actionable, high-impact narratives.

A New Competitive Landscape

Instead of paying influencers, projects now compete for recognition from top Yappers.

The battle isn’t for ad space, it’s for thought leadership that moves markets.

Kaito’s model transforms influence into a financial asset. Attention is no longer for sale, it’s proof-of-value.

*“The future of attention isn’t about who shouts the loudest—it’s about who actually moves the market.”*

The AI Dilemma: Can Kaito Keep the Signal Clean?

Turning influence into a tradeable asset is ambitious, but keeping it clean is the real challenge. Kaito’s AI is the backbone of its InfoFi vision, deciding which insights have real market value. But insight isn’t a fixed metric; it’s subjective, fluid, and easily gamed. If the AI fails to distinguish between actual market-moving narratives and manufactured noise, the entire system crumbles.

Right now, Kaito’s Yap scoring model aims to reward originality and credibility, but how long before degens start reverse-engineering it? Crypto thrives on arbitrage, if there’s a way to farm influence, someone will find it. Keyword stuffing, engagement pods, and spam farms could flood the network, tricking the AI into boosting low-quality posts. If the system becomes predictable, it won’t be long before we see AI-optimized clickbait threads farming $KAITO instead of surfacing true alpha.

Scalability vs. Accuracy: The Balancing Act

Can AI keep up? Kaito is scanning thousands of posts across X( for yaps) , Discord, and governance forums in real time. The challenge? Avoiding overfitting, where AI starts amplifying the loudest voices rather than the most insightful ones. If it just mirrors Twitter’s biggest influencers, it risks becoming an echo chamber instead of an intelligence engine.

Quality vs. Speed: Filtering millions of posts is one thing, doing it without rewarding spam is another. The AI must constantly evolve, identifying new ways users attempt to game it. A single weak spot, and Kaito’s credibility takes a hit.

*“An AI that prices influence is powerful, but only if it can’t be fooled.”*

AI Agents: The Next Evolution of InfoFi

If Kaito is proving that influence can be measured, priced, and traded, the next step is AI agents moving from passive observers to active market participants. Right now, Kaito’s AI scans X, Discord, and governance forums, detecting early shifts in sentiment before they impact price. But what happens when AI isn’t just analyzing markets, it’s making moves in them?

That’s where AI-agents like aixbt come in. Unlike Kaito, which focuses on Yap scores and tokenized influence, aixbt is built for real-time intelligence tracking. It’s already being used as a go-to source for high-frequency event reporting, think governance proposals, funding rounds, protocol updates, all surfaced before they hit mainstream channels. If Kaito is InfoFi’s credibility engine, aixbt is its newswire on steroids, pulling raw data straight from the source and pushing it to traders before price action follows.

Now, the real question: what happens when these AI agents start trading on their own insights?

The vision isn’t far off. AI-powered decentralized research DAOs could form, curating and verifying information at scale, with models like aixbt acting as autonomous market analysts. Tokenized attention flows would no longer just reward influencers but fund entire AI-driven research ecosystems, replacing manual due diligence with on-chain verified, AI-ranked intelligence.

*“AI might not just be watching the markets anymore, it’s learning how to play the game.”*

The AI Arms Race: InfoFi’s Biggest Test Yet

InfoFi is flipping the script on the attention economy, but the real battle is just beginning. The shift from vanity metrics to market-driven influence sounds great on paper but execution is everything. AI is both the backbone and the biggest risk. If Kaito, aixbt, and similar projects succeed, we get a decentralized intelligence network where attention, credibility, and capital are directly linked. If they fail? We’re back to engagement farming, just with better bots.

But this shift isn’t just about trading signals and tokenized influence. It’s about how AI is reshaping the way we access, filter, and value information itself. Kaito is trying to turn insights into assets. Aixbt is making real-time information a tradable advantage. CookieDotFun is gamifying participation. Each takes a different approach, but together, they represent a fundamental evolution: information is becoming financialized, and AI is the new gatekeeper.

Whether this leads to a smarter, fairer system or just a more complex attention economy will depend on execution, adaptability, and whether AI can keep up with the humans trying to outsmart it. The outcome isn’t set, but one thing is clear: the way we consume, trade, and profit from information is never going back to what it was.

About Cluster Protocol

Cluster Protocol is the co-ordination layer for AI agents, a carnot engine fueling the AI economy making sure the AI developers are monetized for their AI models and users get an unified seamless experience to build that next AI app/ agent within a virtual disposable environment facilitating the creation of modular, self-evolving AI agents.

Cluster Protocol also supports decentralized datasets and collaborative model training environments, which reduce the barriers to AI development and democratize access to computational resources. We believe in the power of templatization to streamline AI development.

Cluster Protocol offers a wide range of pre-built AI templates, allowing users to quickly create and customize AI solutions for their specific needs. Our intuitive infrastructure empowers users to create AI-powered applications without requiring deep technical expertise.

Cluster Protocol provides the necessary infrastructure for creating intelligent agentic workflows that can autonomously perform actions based on predefined rules and real-time data. Additionally, individuals can leverage our platform to automate their daily tasks, saving time and effort.

🌐 Cluster Protocol’s Official Links: